Welcome back to the Fancensus Spotlight, our mission is to help you understand how games compete for attention and identify the winning strategies. As Black Friday dust settles, discounts, DLC, and late‑year launches show exactly how storefronts and social buzz can still reshape the conversation in a “quieter” part of the release calendar. So let's unpack the data.

Console Discoverability – Deals Page Only (24th–30th November)

On Xbox, Black Friday turned the deals page into prime real estate, with every top‑five title embedded in the main promotional banners. The Outer Worlds 2 led the pack with a 100 Flare score, pushed as the newest headliner in the sale and supported by multiple solo dashboard placements despite only being a month old and already 20% off. NBA 2K26 followed closely with a 99 Flare Score, leaning on aggressive 55% discounts, while Ready or Not enjoyed a 20% discount plus a free trial, a powerful combination for discoverability. Fallout 76 capitalised on a 75% discount and prominent mentions of its C.A.M.P. Revamp update, and Assassin’s Creed: Shadows benefited from a 40% off promotion with the title also launching on Switch 2 today.

On PlayStation, EA Sports FC 26 took the crown with a 100% Flare score, ranking sixth on Xbox but topping PS5 thanks to a 50% discount and major, sometimes sponsored, banner placements on the deals page. Death Stranding 2: On The Beach landed in second with 95%, supported by a 25% Black Friday discount and widespread banner presence across most countries. Cyberpunk 2077, The Last of Us Part 2, and Mortal Kombat 1 rounded out the top five as part of a PlayStation Plus‑driven 33% off promotion, with shared banner placements; interestingly, those placements did not appear on the UK or US stores, even though the promotion itself was still available there.

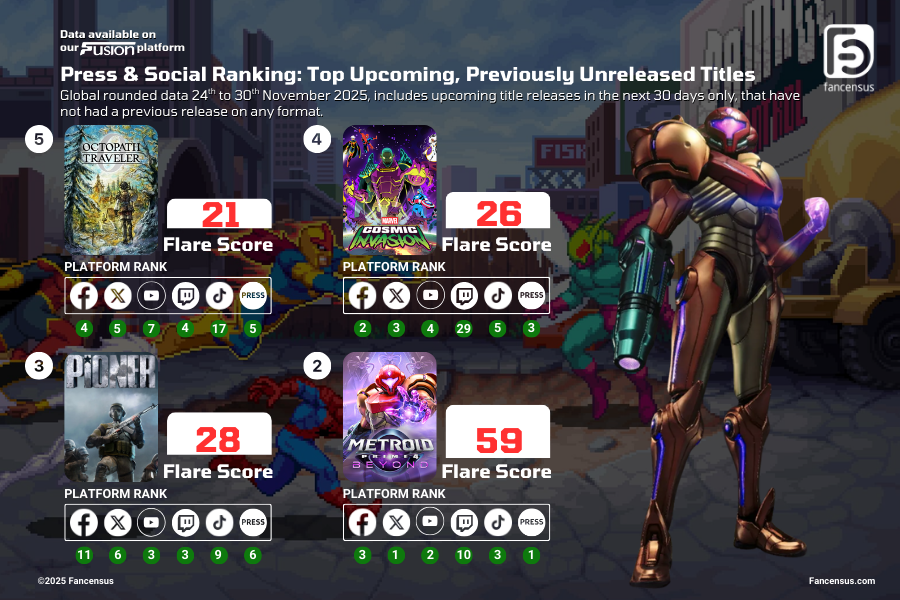

Press & Social Flare – Upcoming Products With No Prior Releases (Next 30 Days)

In fifth place Square Enix’s Octopath Traveler 0, the prequal to the original Octopath Traveler game, scored 21 in press & social media flare ahead of it's 4th December release. Press was focused on returning and new characters and fresh gameplay systems. GameSpot’s “Everything To Know” video gathered nearly 30k views, reinforcing that there is still healthy appetite for the series’ distinctive JRPG formula. Dotemu's Marvel Cosmic Invasion ranked fourth with 26, entering the market as a new Marvel beat‑’em‑up that released yesterday after a week of rising interest. Official gameplay and opening animation trailers on IGN’s YouTube channel pulled in around 200k and 500k views respectively, while a TikTok from Darthtanzo outlining its 15 playable characters approached 200k views. GFAGames' Pioner came in third with 28, building hype ahead of its 16th December early access release, fuelled by over 500k Steam wishlists, an IGN‑featured trailer, and a million‑view YouTube video from Вестер discussing regional blocking. Dropping from first place last week Nintendo's Metroid Prime 4: Beyond scored 59, second place overall but still holding the top spot in the press and on X as new details and the “Survive” trailer trickled out. Nintendo’s acquisition of Bandai Namco Studios Singapore, the team behind the original Metroid Prime 4, added another layer to coverage.

Spotlight Title: Destiny 2 – Renegades

Bungie's Destiny 2 – Renegades marks a major milestone for Bungie’s live‑service giant, arriving today as the tenth expansion since the game’s original 2017 launch. This DLC is tapping directly into sci‑fi fandom with its Star Wars‑inspired gear, especially the lightsaber‑like “Praxic Blade,” which has become the focal point of countless online discussions. Bungie has been careful to clarify in interviews and articles that while the expansion is clearly inspired by Star Wars, it is not a direct crossover, even as the team works closely with Lucasfilm behind the scenes. An angle that has intrigued both players and industry watchers.

Press activity peaked on 26th November following the launch trailer drop on the 25th, with 149 headlines across 92 media sites. Most coverage revolves around three themes: the extent and execution of the Star Wars inspiration, the pressure on Renegades to re‑energise lapsed players after The Edge of Fate underperformed expectations, and the broader question of how long Destiny 2 can sustain its expansion‑driven model. Social activity also spiked on the 26th. On TikTok, Destiny 2’s own “Authentically Destiny. Unmistakably Star Wars.” clip cleared 250k views, while Bungie’s developer livestream on Twitch drew more than 200k viewers. Interestingly, the most‑watched YouTube content was not the official trailer but Mr. Fruit’s “The brutal truth about Destiny 2 Renegades,” in which the creator shared hands‑on impressions from a visit to Bungie HQ. Signaling how influential honest creator commentary remains for live‑service expansions.

If this week proves anything, it is that discounts and DLC are only part of the story, true success lives where storefront visibility, smart timing, and the right social conversations intersect. For developers and publishers planning 2026, treating this kind of data as optional is a luxury the market no longer supports. Using Fancensus‑style insights to understand where your title is visible, who is talking about it, and why, can turn a good launch into a long‑term win rather than a brief spike that quickly fades.